2022 tax brackets calculator

The next six levels are taxed at. Single filers tax brackets 2022 Married filing jointly tax brackets 2022 Married filing separately tax brackets 2022 Head of households tax brackets 2022 What are the standard deductions.

How To Calculate Income Tax On Salary In Pakistan Learn How To Check Your Income Tax Rates On Your Monthly Salary Online In 2022 Income Tax Income Salary

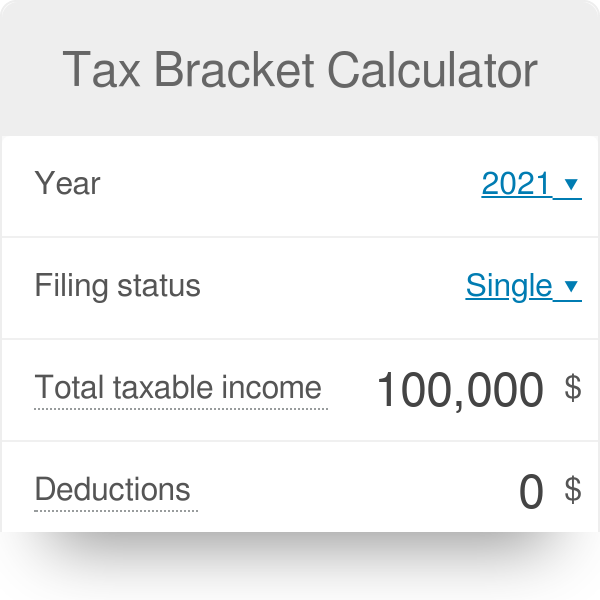

Calculate your income tax bracket 2021 2022.

. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. There are seven federal tax brackets for the 2021 tax year. The calculator reflects known rates as of June 1 2022.

This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available. Your Federal taxes are estimated at 0. These are the rates for taxes due in April 2022.

Kenya Power Tokens Calculator. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. The top tax rate for individuals is 37 percent for taxable income above 539901 for tax year 2022.

0 would also be your average tax rate. It will be updated with 2023 tax year data as soon the data is available from the IRS. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income.

18 of taxable income. The more income you receive. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Sea Cargo Cost per. It is mainly intended for residents of the US. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The more tax you will be paying. 10 12 22 24 32 35 and 37. And is based on the tax brackets of 2021 and 2022.

The IRS changes these tax brackets from year to year to account for inflation and other changes in economy. Online income tax calculator for the 2022 tax year. Nairobi Water Bill Calculator.

Yearly Monthly 4-weekly 2-weekly Weekly Daily. Please enter your income deductions gains dividends and taxes paid to. Once you have entered the necessary information into our Federal Tax Brackets Calculator you will be provided with a full breakdown of how much tax you will be paying and the amount of tax that falls into each bracket.

The lowest tax bracket or the lowest income level is 0 to 9950. 2022 Tax Calculator 01 March 2021 - 28 February 2022 Parameters Period Daily Weekly Monthly Yearly Periods worked Age Under 65 Between 65 and 75 Over 75 Income Salary Bonus included in salary Deductions. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. IT is Income Taxes. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000. See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions. PAYE Calculator Calculator Team.

At the current interest rate a. More information about the calculations performed is available on the about page. Our tax refund calculator will show you how.

This calculator is integrated with a W-4 Form Tax withholding feature. Please enter your salary into the Annual Salary field and click. The IRS has set seven tax brackets 2022 taxpayers will fall into.

Your income puts you in the 10 tax bracket. Your bracket depends on your taxable income and filing status. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10.

2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. This simplified will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022.

Explore 2021 tax brackets and tax rates for 2021 tax filing season. CTEC 1040-QE-2662 2022 HRB Tax Group Inc. Federal Income Tax Calculator Calculate your federal state local taxes Updated for 2022 tax year on Aug 31 2022.

The 2022 tax values can be used for 1040-ES estimation planning ahead or. This calculator has been updated for the 2022 tax year. 40680 26 of taxable income above 226000.

You can also create your new 2022 W-4 at the end of the tool on the tax return result page Start the TAXstimator Then select your IRS Tax Return Filing Status. Your tax bracket is determined by your taxable income and filing status. For example a single taxpayer will pay 10 percent on taxable income up to 10275 earned in 2022.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 6 hours agoThis week the average interest rate on a 10-year HELOC is 620 a slight jump from the previous week when it was 611 and 255 the low over the past year. Updated with 2022-2023 ATO Tax rates.

The next 305k is taxed at 12. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

The following tables represent the income tax rates in different tax brackets we used in the 2022 tax brackets calculator. Enter your tax year filing status and taxable income to calculate your estimated tax rate. Estimate your tax refund with HR Blocks free income tax calculator.

Taxable Income Calculate These calculations do not include non-refundable tax credits other than the basic personal tax credit. 73726 31 of taxable income above 353100. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000.

Kenya PAYE Calculator with Income Tax Rates Of January 2022 Calculate KRA PAYE Net Pay NHIF and NSSF Contribution. This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased out.

There are seven federal income tax rates in 2022.

Excel Formula Income Tax Bracket Calculation Exceljet

Getting Back Your Money How To Claim An Income Tax Refund Tax Refund Income Tax Finances Money

Tax Bracket Calculator

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

Ontario Income Tax Calculator Wowa Ca

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Sales Tax Calculator

Ready For Tax Season Federal Income Tax Guide For 2018 Financeideas Familyfinance Tax Guide Federal Income Tax Income Tax

Take These 5 Steps For A Quicker And Bigger Tax Refund In 2022 Barron S Tax Preparation Tax Preparation Services Tax Services

Casio Sl797tvblack Tax Calculator In 2022 Calculator Casio Tax

Tax Percentage Calculator In 2022 Online Taxes Tax Saving Investment Online Income

Pin On Airbnb

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

2021 2022 Income Tax Calculator Canada Wowa Ca

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Californiataxtable Income Tax Brackets Tax Brackets Tax Prep

Komentar

Posting Komentar